Foreword

Since May 2017, Taiwan has been levying a 5 % business tax in accordance with the Business Tax Act (i.e., consumption tax) on transactions for electronic services provided by foreign e-commerce operators. All international operators without a fixed place of business in Taiwan, such as Netflix, Spotify, Google, Adobe, etc., are required by law to add and collect a 5% business tax if they sell electronic services to end consumers in Taiwan.

OpenAI also completed its tax registration on May 1, 2025, and officially began collecting a 5% business tax from users who do not provide a valid Taiwanese Unified Business Number, and issuing government electronic uniform invoices (eGUI) in accordance with regulations. This tax is not an additional fee but a tax mandated by Taiwanese law.

Reasons and Process for Business Tax Collection

Legal Basis According to an announcement from the Ministry of Finance, foreign e-commerce platforms selling electronic services to users in Taiwan should proactively collect and declare a 5% business tax.

Differences Before and After Registration Before Registration: OpenAI had not yet completed tax registration in Taiwan; therefore, no tax amount was shown on orders. After Registration: After completing tax registration, OpenAI legally issues government electronic uniform invoices (eGUI) to consumers in Taiwan, with the 5% business tax clearly itemized on the invoice amount.

Platform Subscriptions and Business-Specific Benefits

- App Store and Google Play Subscriptions: As these platforms already include business tax in their charges, OpenAI will not add an additional 5%.

- Corporate Users (Companies): By entering a valid Unified Business Number at checkout, the transaction will automatically be exempt from business tax.

Calculation Method for the 5% Business Tax

Taiwan operates under a value-added business tax (VAT) system. For businesses, the net tax payable to the government is generally calculated as: Output VAT – Input VAT

where output VAT is the tax collected on sales and input VAT is the tax paid on business purchases.

For end consumers—such as a ChatGPT Plus subscriber—the calculation is straightforward: 5% business tax is added to the pre-tax price of the service.

- Amount before tax: USD 20

- Business tax (5%): USD 1

- Total payable: USD 21

The USD 1 is reported as OpenAI’s output VAT for this transaction and will be remitted to the Taiwanese tax authority after offsetting eligible input VAT.

Method for Setting Up Tax Exemption with a Company’s Unified Business Number

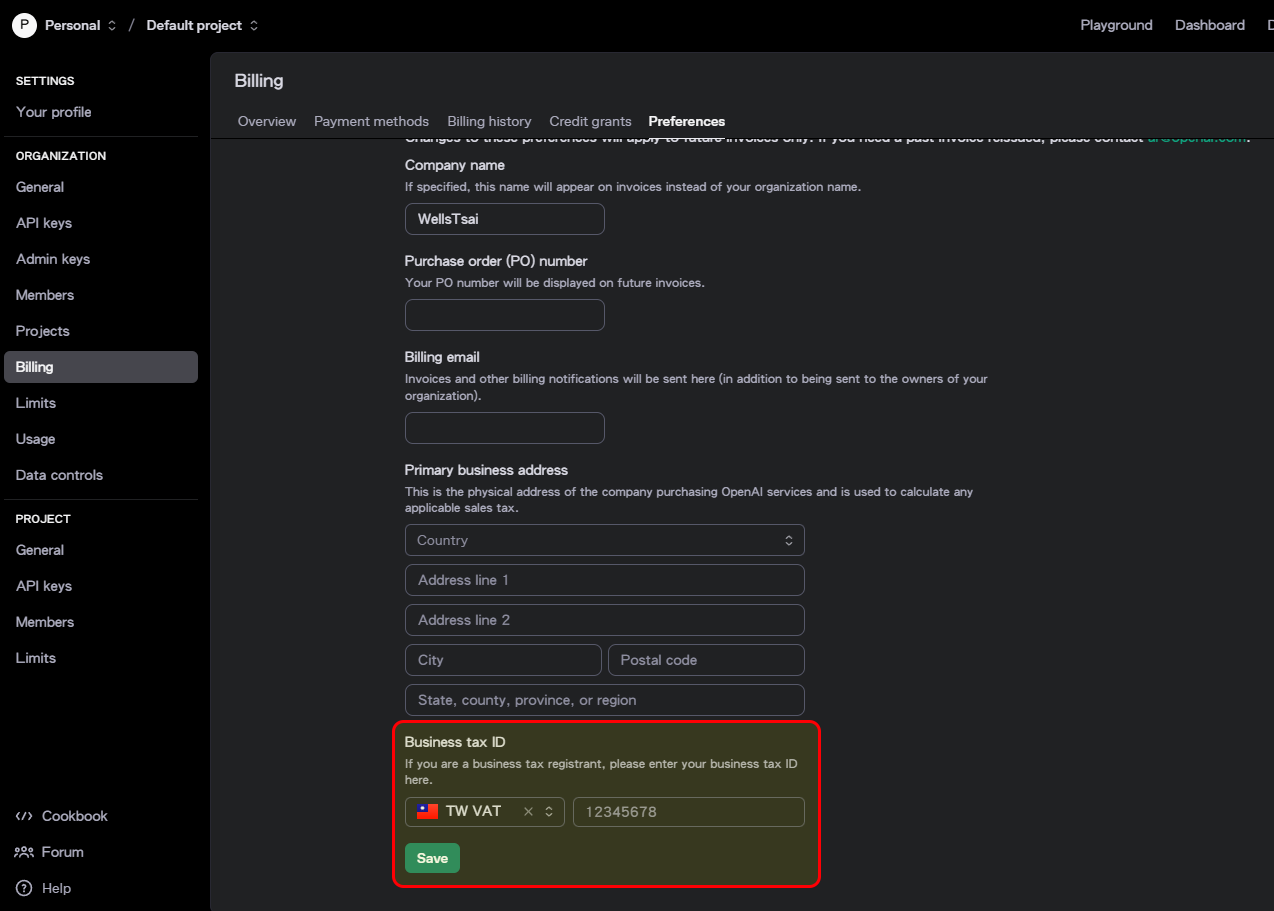

Go to the OpenAI Billing page, locate the Business tax ID field, select TW VAT, and then enter your company’s 8-digit Unified Business Number in the adjacent box to complete the tax-exemption setup.

Note: The above applies only to OpenAI API billing. For ChatGPT, it’s unclear whether the absence of a VAT-ID option is because I’m on an individual account or because the interface hasn’t been released yet. I may need to wait for a future update.

Switching Regions to Avoid VAT

A common online workaround to bypass the 5 % business tax is to modify your billing address:

To change your address, go to the ChatGPT Subscription settings, click Manage, then edit your payment information and billing address:

By switching your billing address to a VAT-exempt jurisdiction (e.g., Hong Kong, Bermuda, Cayman Islands, British Virgin Islands), the USD 1 tax will not be charged, since the order is no longer billed to Taiwan. However, most online sources warn there is a legal risk—“extremely low but not zero.”

Conclusion

OpenAI’s decision to comply with Taiwanese tax regulations by applying a 5% business tax highlights how global digital platforms are placing increasing emphasis on local compliance. Both corporate and individual users should keep their billing information up to date and file their taxes accurately—based on actual usage and their tax status—to mitigate potential risks.